Even if the business environment is evolving rapidly, financial management remains the cornerstone of sustainable growth and success for organizations. As we are at the verge of stepping into 2025, this vital business aspect has taken on new dimensions, incorporating cutting-edge technologies and innovative approaches.

At its core, financial management is about planning, controlling, and managing financial resources to achieve the objective of keeping business profitable and debt-free. It’s the art of utilizing every penny in an efficient way along with having a precise record of each expense. This helps ensure that the company not only survives but thrives in an increasingly competitive market.

Now, in 2025, when businesses are aggressively turning towards automating and adopting technological advancements to increase their operational efficiency and productivity, financial management isn’t limited to balancing books or managing budgets. It is about embracing automation, leveraging real-time insights, and aligning financial strategies.

This guide will help you understand every aspect of financial management, from its foundational principles to emerging trends shaping the industry. If you are curious about knowing the secret behind keeping firms financially fit then, this comprehensive guide is specially written for you.

Enjoy reading!

What is Financial Management:

Like any other management, financial management is optimizing the utilization of money for your business. It involves planning, budgeting, foreseeing expenditure, etc.

The aim of financial management is to effectively manage financial resources and achieve profitability, stability, and long-term sustainability.

Elements of Financial Management:

Financial management comprises the following elements:

Financial planning –

Financial planning is an important element of financial management. It reflects the cash needs of an organization according to its business plan.

This planning tells an organization how much money it requires to achieve its goals. Financial planning is a continuous process.

While making a financial plan, both fixed and variable expenses must be considered.

With proper financial planning, organizations can make sure that ample liquid is available for day-to-day functions. Besides, planning helps organizations to formulate policies and SOPs regarding money handling and expense.

Financial reporting-

Financial reporting is a crucial part of financial planning. Reporting is showcasing the financial status to various stakeholders like board members, investors, banks, governments, and in some cases, the public.

Financial reporting comes out of financial accounting, and it shows the concerned people how the organization benefits from the money it holds.

Financial controls –

Financial control ensures maximum profits for the organization and stakeholders. It implements policies and procedures designed in the planning stage.

It also documents and identifies any money leakage. By identifying gaps, it can fill them to churn maximum output of monetary resources.

Besides earning profits, financial control also prevents theft. With strict control over overspending, there is very little possibility of fraud and theft.

Financial decisions –

It is making an informed choice after considering all the options. Once all the options and alternatives of plans are observed, the best plan is chosen to be executed.

This plan must match up with planning, reporting, controlling, and other factors.

Allocation of funds –

Various departments of an organization will get different shares of money based on their requirement. The allocation of money to a department is proportional to the additional value a department can give to the growth of an organization.

Therefore, allocation of funds is also an important aspect of financial management.

Cash flow –

It ensures that a company has enough amount of liquid funds to operate on a regular basis. Poor cash flow results from various factors like ordering too much material when there is a slowdown in demand.

Stocking without having an account of previous stocks, offering long credit periods, etc., also causes a cash crunch.

Stocking can be streamlined if organizations deploy an ERP software like BatchMaster ERP for their inventory management. Such ERPs have an efficient planning module to plan purchases efficiently and thus avoid wastage.

To know how the inventory module of BatchMaster ERP works read- Ultimate Guide to Inventory Management for 2025

The Objective of Financial Management:

Here are some important objectives of financial management:

- Maintenance of Liquidity

- Business Sustainability

- Risk mitigation

- Profit maximization

- Efficient fund allocation

- Enhancing departmental efficiency

Importance of Financial Management:

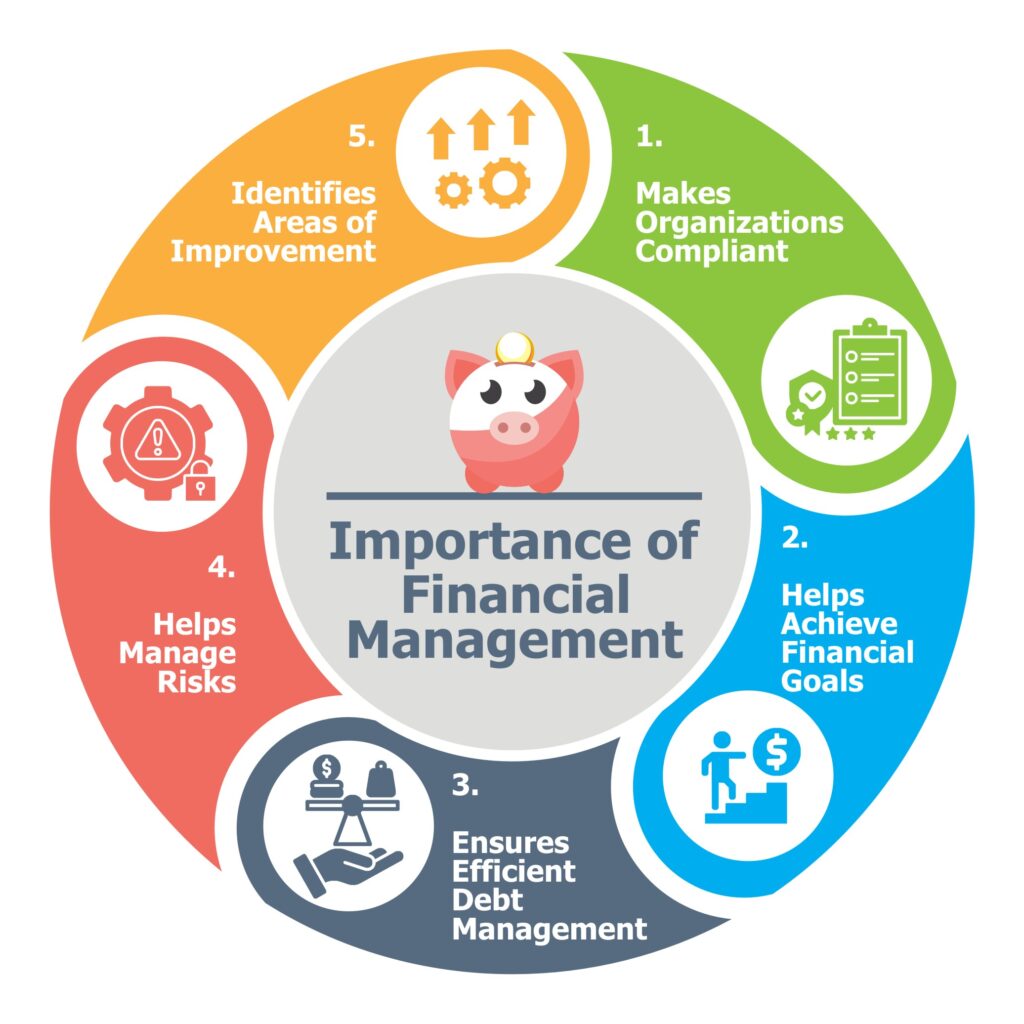

Financial management plays a key role in the sustenance and growth of an organization. With effective financial management, an organization can achieve self-reliance and can transcend on the growth trajectory. Besides, effective financial management has many advantages:

It makes organizations compliant –

Every organization needs to comply with governmental financial laws and regulations. There are specific guidelines by the government of each country to maintain books, show transactions, and maintain records.

With effective financial management and planning, organizations meet the mandates in time to avoid penalties.

Abiding by compliance fosters ease of business, and eventually, a smooth business makes a happy customer.

The finance module of BatchMaster ERP helps organizations to be compliant with the finance rules and laws. It offers a Finance Suite which is a complete package in itself and covers all financial legal mandates like Audit Trail, e-Signature, e-Bill, etc.

Helps achieve financial goals–

Good financial management helps organizations provide a framework and necessary techniques to ensure efficient allocation, monitoring, and utilization of resources. By streamlining budgeting, cost control, and cash flow management, it helps manufacturers minimize waste and maximize profitability.

It even provides real-time insights into operational expenses enabling informed decision-making that aligns with the long-term objectives of keeping the organization profitable.

Ensures efficient debt management-

Proper financial management helps organizations manage their debt in an effective manner. It ensures a clear understanding of outstanding debts, repayment schedules, and interest commitments, allowing businesses to prioritize repayments and avoid penalties.

Effective financial management involves creating detailed cash flow forecasts and budgets, ensuring sufficient funds are allocated for debt without compromising operational needs.

Additionally, it enables organizations to assess their debt-to-income ratio, evaluate borrowing costs, and make informed decisions about reducing liabilities. This way, organizations can achieve long-term financial stability.

Helps manage risks –

Risk is an inevitable part of business. Sometimes foreseen or sometimes unseen, risk can be a speed breaker in the way of growth.

Effective financial management helps organizations foresee the risk, prepare a combat plan, and help them navigate it.

Identifies areas of improvement –

Financial management drills down to each department and scrutinizes various financial leakages.

These leakages can occur due to poor practices, procedures, inefficient workforce, lack of resources, etc. Financial management figures out these dark areas and rings the bell to improve.

Who is Responsible for Financial Management?

Although finance managers have a lot to do in financial management, the CFO of the organization has a larger say and pivotal role to play.

Since an ERP gives a comprehensive outlook to CFO/Finance Managers, the role of a financial management tool like BatchMaster ERP is very important.

A Finance ERP like BatchMaster ERP has numerous benefits to offer. It simplifies financial record keeping, and year-end closing besides providing in-depth analysis of the financial movements for better reporting.

To know the benefits in length click here.

There are many features of an ERP for Financial Management Systems, know them all here.

Final Thought:

The domain of financial management is much wider than accounting. To make an apt plan for financial management, a finance manager must have a drill-down view of every department.

BatchMaster ERP enables finance managers of process manufacturing organizations to get this unified view both in a bird’s eye and indepth format.

With easy and seamless integration with various accounting software like Tally, Sage, Microsoft Dynamics 365 Business Central, and QuickBooks and having its own accounting software named BatchMaster Finance, BatchMaster ERP is the perfect tool for your financial management.

To know how you can harness the power of BatchMaster, write to us at sales@batchmaster.co.in.