Small and medium enterprises (SMEs) never find it easy to run their business operations.

For them, it becomes a bit daunting to handle the front-office as well as back-office operations efficiently at the same time, with their employees sharing multiple roles due to the limited resources.

In such a scenario, automating tasks with the use of business tools helps them big time.

Such tools improve the efficiency of their processes, facilitate strategic decision making, and streamline the operations through smart task delegation, thus enabling them to get more done with the resources at hand.

One classic example is the payroll management software

A complex process to handle, payroll can get more complicated when handled manually.

Ensuring that the salaries of all the employees have been computed accurately, taking into consideration all the variables such as reimbursements, leave, attendance, etc., is no mean feat.

And despite all the meticulous care, if the guy managing the payroll still makes an error in computation, the rectification process thereafter could be tedious and time-consuming.

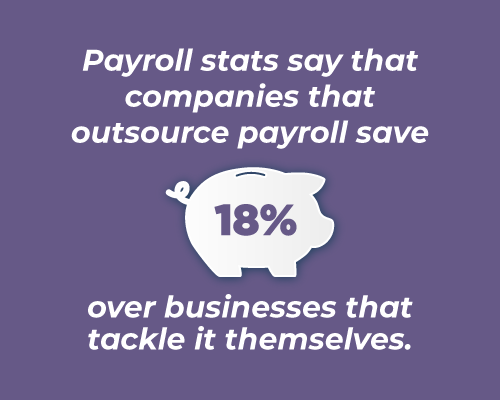

That’s why most of the small/medium businesses outsource it. But using payroll software, SMEs can save costs, time, and other valuable resources that can be deployed elsewhere.

A payroll system has plenty of benefits for SMEs, as it significantly impacts their bottom-line, speeds up work, streamlines workflows, rids them of human errors, and helps become more productive on the whole. Below, we discuss 12 of the biggest advantages of using a payroll software for your SME. Read on:

Better accuracy-

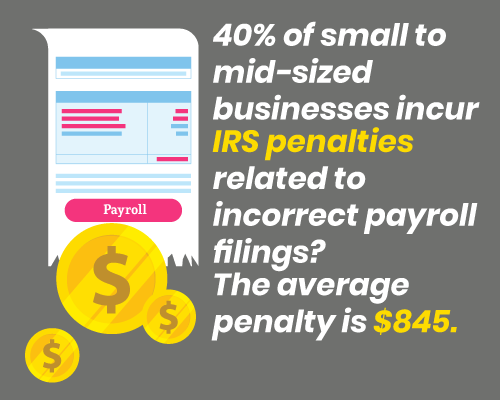

Making a mistake while manually processing payroll could prove costly for SMEs, attracting huge penalties if it’s made on the employment taxes front, and even a legal action if it’s made in an employee’s salary computation.

An automated payroll software easily calculates the withholding tax as well as salary for every employee based on data entry, and eliminates the risk for human errors in payroll.

Save time, money, and other resources –

Managing payroll manually can eat-up a lot of time. But by using payroll software, small businesses can automate the payroll process, and save their employees’ precious time.

Also, being available on Cloud, it can be availed on a monthly, quarterly, half-yearly, or on annual basis, thus delivering cost savings.

The resources (time, money, & manpower) saved could be better spent on other areas of the business.

Data security –

For any business small or big, payroll data is sacrosanct. Due to its sensitive nature, as it contains key information such as mailing addresses, bank details, etc., there’s a need to secure it.

A good payroll software can securely lock down your payroll data, and protect it from potential threats.

Handy during audits –

For any business, it is an absolute necessity to have an audit trail for all its financial aspects including payroll.

Only a payroll system can guarantee a completely transparent audit trail in a matter of minutes, providing logs of salary and other payments, and details of taxes and other rates, and proving all transactions were proper.

Handy during audits –

With every passing year, the tax tables and superannuation rates will continue to get more complex, making it difficult for small businesses to comply with them.

But a payroll software can keep updating its system to stay on top of federal and state requirements. It can also save you time by paying employees electronically when processing payroll.

Reports generation –

While manual methods and ways always keep you occupied, often providing incomplete and inaccurate data, a payroll management system provides you with multiple reports, such as reconciliation reports, MIS reports, customizable payroll statements, and other statutory as well as user-defined reports.

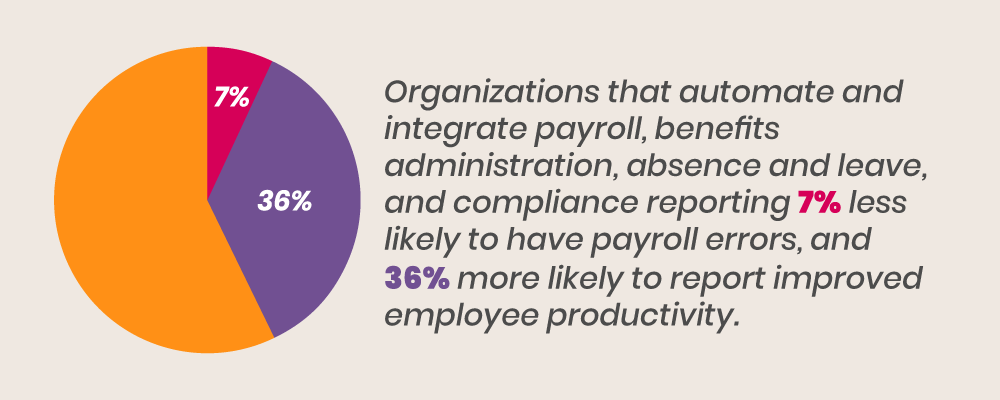

Easy integration options –

SMEs often find it difficult to switch between operations while working on disparate systems for data such as leave, attendance, and employee information, for processing payroll and calculating taxes.

However, a good payroll software, ably supported by a strong integration framework, acts as the single source of truth for all dimensions of an employee, saving them a lot of data entry and verification time.

Simple and fast payroll reconciliation –

A payroll management system offers small businesses with a variety of payroll reconciliation tools, allowing them to verify accuracy in each payroll, compare current and previous month’s payroll, and also customize salary register and payroll statements as per their needs, besides ensuring an error-free payroll.

Scalable –

Scalability is yet another advantage a payroll management system provides to the small businesses, which may not remain an SME forever.

Once a small business starts growing, the system allows it to add new employees whenever necessary without any additional effort.

Employee satisfaction –

Resorting to disparate systems, or worse, manual methods put extra pressure on the employees and consume a major chunk of their productive time.

But by using a payroll software, an SME can automate the processes, increase the efficiency of the operations, eliminate the chances of errors, and most importantly, make jobs easier for employees, thereby enhancing their satisfaction.

Ease of use –

A payroll management system is easy to use, and any person without much technical know-how can use it. It doesn’t require any specialized training or an accounting background.

Besides, any payroll software that’s available on Cloud, can be accessed from anywhere, and anytime, in a secure manner using an internet connection.

Uninterrupted support –

When SMEs use paper-based payroll systems, or do things manually, they basically rely on the employees who manage them.

But what if the employees leave? A payroll software system offers benefits such as continuous, 24×7 customer support, to resolve the problems experienced by the users while using the software.

Conclusion

Paper-based payroll systems and manual methods are things of the past. Investing in payroll management software, which comes with the benefits mentioned above, is the need of the hour for the SMEs.

If your SME is still stuck in the past, get in touch today to make the switch to BatchMaster HeRd, a secure & reliable payroll software that can manage other HR-related operations too.