India is currently battling the devastating second wave of the COVID-19 tragedy, which has had a massive impact on its healthcare systems.

Despite several reforms and increased investment in the sector, the rapid spread of the second wave of coronavirus has left the country gasping, both literally and figuratively.

Many other countries badly affected by the pandemic also witnessed the second wave late last year.

Countries such as the United States of America (USA), France, Germany, United Kingdom (UK), Italy, and Spain also saw the wave reaching the critical stage.

The second wave not just exhausted the healthcare system in these countries, but also had ripple effects on virtually all other aspects of life, including businesses.

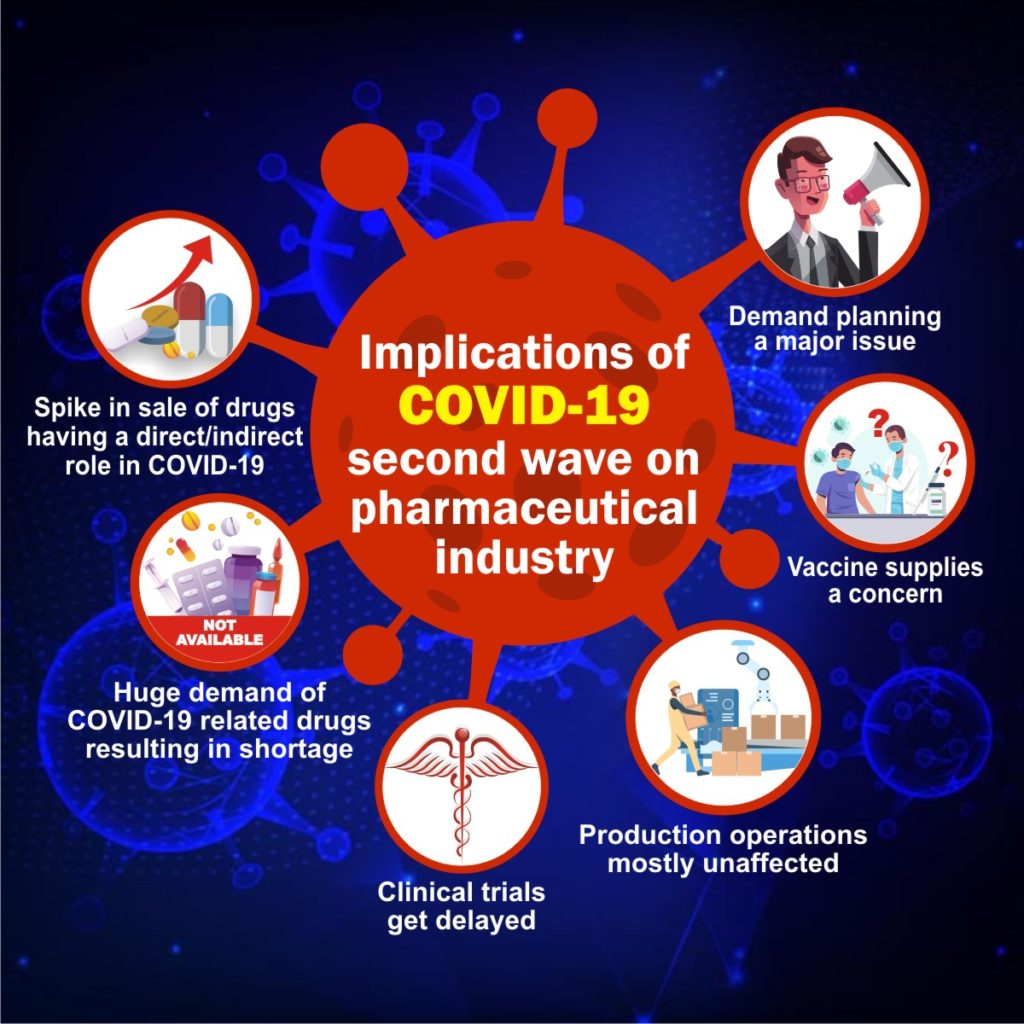

Talking about the pharmaceutical manufacturing industry, the second wave of pandemic has had a bittersweet impact on it- less sweet, and more bitter.

The sweet part first

Talking specifically about India, which is currently in the middle of the second wave, the fresh wave of COVID-19 has resulted in exponential growth for the pharmaceutical industry, as the sales have shot up significantly.

The total sales audit data from IMS Health, world’s largest pharmaceutical market research firm, has revealed the Indian Pharma Market (IPM) grew 59% year-over-year (yoy) in April, 2021, as against 16% yoy in March, 2021, due to the pushed-up sales of COVID-19-related medicines.

The sales numbers of Zincovit, Dolo, Monocef and Betadine – drugs that are used in the treatment of COVID-19 – have shot up.

As the second wave has surged, the COVID-19 drug FabiFlu has witnessed a record spike in sales of approx., 600% in the month of April 2021.

It raked in Rs 351 crore in that month alone, becoming the top-selling brand in the pharma retail market of India, according to the data from the All Indian Origin Chemists & Distributors Ltd. (AIOCD).

Export on the rise

India’s pharmaceutical industry drastically increased the export of drugs post the outbreak of the coronavirus pandemic.

This has stretched well and truly to the second wave as well. A spike in demand for pharma products induced by the pandemic, and hoarding of supplies by some nations in the wake of production disruptions,contributed to this boost of export.

The spike in demand was particularly observed for the active pharmaceutical ingredients (APIs) from India.

The major reason behind this could be the increasing customer diversification away from China and some countries adopting a ‘China plus one’ policy, which refers to the business strategy of avoiding investments only in China and diversification of business into other countries.

The bigger markets such as the USA and Europe have also contributed to this export growth due to increased demand for drugs and raw materials from their end.

Furthermore, several Indian pharma players are in fray to manufacture and export Remdesivir.

Now, on to the bitter part

During the first wave, COVID-19 had disruptive effects on the global supply chain, which created the problem of shortages.

Lot of regions in the world observed lockdown that lasted few weeks, and subsequently resulted in shortage of medicines as manufacturing operations and transportation activities were suspended for the time being.

This time around, there has been a shortage once again. However, it has been more due to high demand than any other reason.

The huge demand for Liposomal Amphotericin B injections, Remdesivir injections, and Fabiflu tablets, among others, has led to a shortage of these drugs and triggered black marketeering.

Essential equipment such as the oxygen concentrators, cylinders, ventilators, rapid testing kits, etc. have also witnessed acute shortage due to high demand.

But a number of countries have sent in the supplies of these essential medical equipment to India through special flights.

Overall impact of the COVID-19 second wave on the pharmaceutical industry

- Business: Big pharma manufacturing companies selling medications for chronic ailments are doing well during the second wave. While the COVID segment is doing well, the Non-Covid segment will have to wait for its recovery, which may now be disrupted by the second wave as hospitals and the overall healthcare infrastructure focus on dealing with it.

- Labor: The first wave of the pandemic in India caused severe disruption on the labor front, mainly due to the reverse migration, as the labor class started returning to their hometowns with operations at the pharma manufacturing units coming to a halt. This issue was partially resolved, but the second wave is again disrupting it to some extent.

- Production: After a brief disruption last year, production at manufacturing sites had recovered. And as things stand, even the latest lockdowns imposed by the state governments in India during the second wave haven’t impacted production.

- Supply:Supplies have generally improved, with raw materials, mostly imported from China, now having alternative sources. However, vaccine supplies remain a concern, as manufacturers are struggling to ramp up.

- Demand planning: While the focus has been on rapidly vaccinating people of different age groups, there aren’t enough vaccines available with many states in India. Till recently, there was an embargo on export of raw materials needed to manufacture vaccines out of the USA. Demand planning is a concern for the pharma manufacturers during this second wave.

- Sales:The gradual easing of lockdown restrictions, coupled with demand for pharma products and bulk drugs in both exports and domestic markets, is driving revenue growth for the pharmaceutical industry. We saw above how the second wave has boosted the sales of drugs having a direct or even indirect role in COVID-19 treatment.

- Distribution: There are distribution issues emerging not mainly due to the logistical or transportation issues, but due to shortage created by huge demand. Remdesivir, used in the treatment of Covid, continues to be out of stock, even though companies have promised to increase production.

- Clinical trials: The surging second wave of COVID-19 has also had an effect on the ongoing clinical trials for various drugs and vaccine candidates. Even as many patients being admitted in the hospitals at present, clinical trials may put pressure on the partner doctors, as the hospitals and staff remain busy with patient care.

In order to manage the second wave and deal with the challenges related to it, the pharma manufacturers need to devise robust strategies, and also require effective tools — such as an ERP software for pharmaceutical industry— that offer support to those strategies.

Pharmaceutical ERP software-one solution to many problems

In the existing times and beyond, the pharma manufacturers will have to indulge in intelligent demand assessment & planning, revamping supply chain strategies, and scaling up production to be ready to meet high demand, among other things. And, an ERP for pharmaceutical industry can be of big help.

BatchMaster ERP for Pharmaceuticals, a best-in-class pharma ERP software, can support all the initiatives mentioned above.

We, at BatchMaster, have been addressing the challenges of pharma manufacturers successfully for over 30 years now.

Even in the existing times, and the years to come, we will continue to make pharma businesses simpler through our pharmaceutical ERP software.

Get in touch with our experts to schedule a free demo, and figure out how a pharma ERP can help your business in these times, and help it prepare better for such times in the future.