“Madam, here is your receipt. Thank you for the payment”.

“Sir, I have sent the invoice. Please make payment before last day of the month”.

You might have come across such conversations in some point of time. Most of the time it seems ok, but have you ever noticed use of the words “invoice” and “receipt”? It becomes all the way more important if you are in a B2B setting.

Most of the people confuse between the two words. Barring some similarities, they are extremely different and are used for different meaning and context.

If you are among those who mingle these two terms, don’t worry! This blog will shed light on the terms so that next time you don’t use receipt in place of invoice and vice versa. Stay tuned till the end.

- What is an Invoice?

- Characteristics of an Invoice

- Use of Invoice

- What Should an Invoice Include?

- What is a Receipt?

- Characteristics of a Receipt

- Why Should Business Issue a Receipt?

- What Should a Receipt Include?

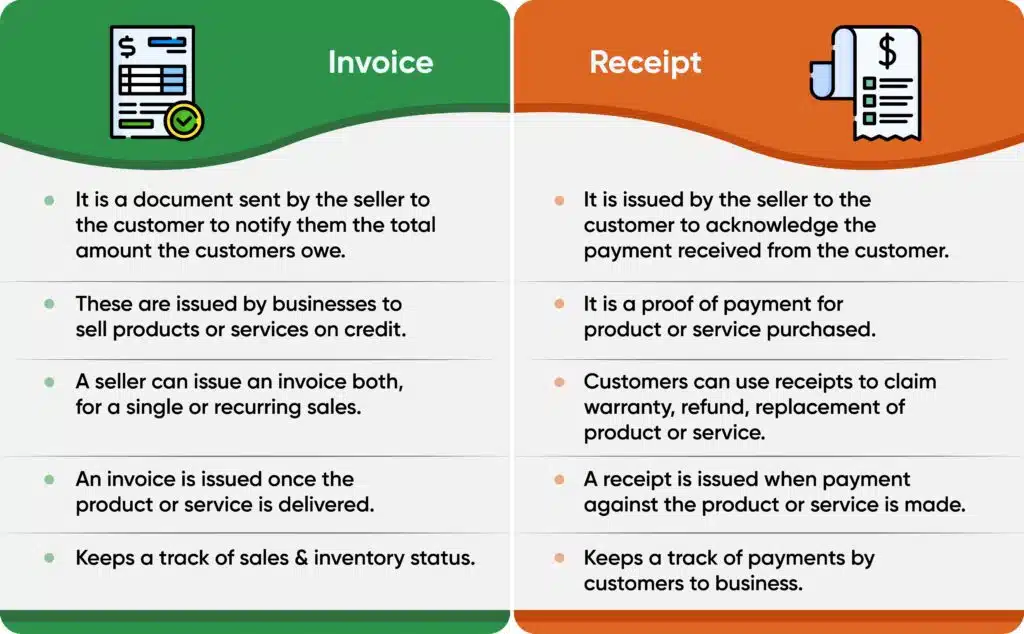

- Comparative Difference Between Invoice and Receipt

- Similarities Between Invoice and Receipt

- Concluding Thoughts

What is an Invoice?

An invoice is a financial document that a business sends to a customer against the service rendered or goods sold. Invoice is a document which is a proof of purchase of a service or a good.

When a business sends an invoice, it is intimating the customer that he owes some money, and the business is requesting for a payment. Invoice is also known as bill of sale. It is also used as a record for the accounting process. It is worthwhile to mention here that bill, and invoice are the two different sides of the same coin.

When an organization sends an invoice to a customer it requests for payment. A customer at the receiving end receives a bill which shows the amount he owes to the organization. Hence, Invoice is a document from business’s end whereas bill is the document from customer’s end.

Characteristics of an Invoice

- An invoice is a document to request payment from the customer.

- An invoice is issued first and then payment is done.

- An invoice is not issued for every type of sales transaction.

- It is not a proof of payment confirmation.

- Invoices are of different types and are different for each industry. Some common types of invoices include- proforma invoice, commercial invoice etc.

Use of an Invoice

A customer receives an invoice after he agrees to purchase a service or a product by the business. An invoice is issued before goods are delivered or at the same time. In case of a service, invoice is issued before or directly given after the service is completed.

An invoice is issued to notify customer that payment is due. It also serves as a record for issuing business so that it can track its receivable. There was a time when paper-based invoices were sent/given. With advent of technology and new-age tools like Accounting software or an ERP software, the invoicing process has become digitized and automated.

Now the business can send invoices to its customers in digital format, leaving behind the worries of misplacing it or tempering. This also enhances the speed of invoicing and reduces errors involved.

What Should an Invoice Include?

An invoice must include:

- Your business name, contact information and logo.

- Customer’s name and contact information.

- Invoice number, the date you created it, and date of service/product given.

- Description of goods/service provided including unit price and quantity.

- Payment information, include payment due dates, total amount, and acceptable forms of payment.

- You can also add terms and conditions for customers at the end.

What is a Receipt?

A receipt is a financial document which shows that liable amount has been paid against service or good. It is proof of payment and also known as payment receipts or sales receipts. A business sends its customers a receipt when it receives amount which the customer owed against the service or the good purchased from the business.

This document is useful for legal purpose and also acts as a proof when requesting refund or during exchange of goods or to claim a warranty. The receipt contains date, amount paid, and product information.

Characteristics of a Receipt

- Receipts are issued only when payment has been made.

- Businesses consider receipts as proof of payment.

- It is also used to identify if purchase has been made by the said business.

- It can be used as a proof for any legal proceedings.

- They are also necessary for tax purpose as proof of certain expense.

- In accounting context, receipts are total cash inflows in a particular time frame.

Like invoices, receipts are also digitized and are generated immediately by POS machines, but some businesses still follow old and traditional paper-pen-based receipts.

Why Should a Business Issue a Receipt?

There are some reasons why a business must issue a receipt. Here are some of them:

- To document that the item belongs to the buyer.

- It acts as a proof for buyer that he has made full or partial payment.

- It serves as a document of ownership for insurance purpose.

- It acts as evidence that the buyer need not to pay sales tax if it has already been paid in the transaction.

- Buyer can claim refund/return (as per the policy) basis receipt date if it comes under the warranty.

What Should a Receipt Include?

A receipt should include:

- Your business name and contact number

- Transaction number or order number

- List of goods or services including unit price and quantity

- Payment date and total amount paid including taxes, fees, and discounts

Comparative Difference Between Invoice and Receipt

Similarities Between Invoice and Receipt

Although, the two documents are different, yet they hold some commonalities which are:

- Both are commercial documents

- They are included in purchase cycle

- Sellers’ and buyers’ details are provided on both the documents

- Both the documents can be used for legal and accounting purposes

Concluding Thought

Both invoice and receipts are quite important document in business. Both have legal, and accounting values, hence both must be free from errors and should be very clear.

With increase in speed and volume of business, the organizations are left with no choice but to generate invoices and receipts faster. Also, generating these documents is very tedious process which is often error prone. That is why businesses are looking forward for an automatic and digitized solution. They are relying upon Enterprise Resource Planning (ERP) for this.

An ERP automatizes the whole invoicing and receipt generation process, leaving behind no scope of errors. A process ERP solution like BatchMaster ERP digitally enters quotation and at due instance converts it into invoices and generates receipts without manual data entry.

Since all the information of invoice and receipt are fetched from the base document (which is already approved), there is no human intervention. This capability speeds up the process of purchase cycle, and alienates chances of duplicate or erroneous data entry, resulting faster processing.

Besides, the software provides a robust finance module, which not only manages invoice and receipts, but also streamlines each aspect of accounting and finance related to your business. You can track flow of each penny on granular basis and get numerous reports to control overall finances of your organization.