BatchMaster Finance Suite

Achieving Financial Compliance and Optimization Is Not a Nightmare, but a Cakewalk Now!

We are living in a digital world that requires speed, security, and agility. Business dynamics are changing faster than ever, and they are coupled with stringent laws and norms. To stay ahead of the curve, businesses must be flexible enough to adapt to these changes.

To facilitate businesses with faster, easier, and more secure financial mandates, BatchMaster introduces the Finance Suite. The Finance Suite is a comprehensive solution that helps you adapt to evolving digital mandates and provides a better and secure ecosystem for all your financial processes.

Working Seamlessly with BatchMaster Finance, It Comprises Four Elements:

Audit logger

Audit logging refers to the process of recording activity within software, and in the case of finance audit logger, it is limited to financial activity. In India, companies are required by law to use software that includes an audit logger facility to record every financial activity. This has been mandatory since April 1, 2023.

As such, having software with audit logging capability is not optional but rather a legal obligation, and failure to comply can lead to significant penalties and damage to a company's reputation.

BatchMaster Finance Suite’s Audit Logger can help organizations identify fraud and comply with current and upcoming laws. The tool allows organizations to keep track of all users who handle financial transactions and securely log entries with timestamps for any changes. This helps organizations to:

- Conduct audit trails, which are records of financial transactions used to trace the history of a transaction from beginning to end.

- Increase data accuracy by identifying duplicate or discrepant data and improving its accuracy.

- Detect fraud by providing detailed information about the movement of financial data.

- Comply with various finance regulations that require companies to follow audit logging for audit trails.

- Make informed finance-related decisions by providing management with proper audit logs that identify financial trends and patterns in financial data.

Overall, implementing an audit logging tool like BatchMaster's Finance Suite Audit Logger can help organizations maintain compliance and security, as well as improve their financial decision-making abilities.

E-signature

E-signature is a digital or electronic version of a conventional ink and paper signature, which indicates the intent of an individual, organization, or authority to agree to the contents of a document, contract, transaction, or administrative data.

In simple words, e-signature is an electronic form of authorization or approval that usually follows certain identity verification and security standards.

As per the guidelines of the Ministry of Corporate Affairs, all filings done by companies/Limited Liability Partnerships (LLPs) under the MCA21 e-Governance program are required to be filed using digital signatures, hence e-sign takes precedence over manual signature and becomes compulsory.

As far as the finance department is concerned, many papers need to travel back and forth. Tacking these papers is time consuming and error prone.

Financial approvals need to go through a process where authorized persons must sign and approve the documents for processing. With papers in hand, scanning, scrutinizing, checking the correctness of the document, and then approving it is a long process that sometimes takes up a lot of time, and most business-critical decisions are delayed.

To match up with the speed of business in the present era, organizations must adopt a new way; they must rely on e-signature.

With e-signature, say no to delays and erroneous entries and embrace fast approvals.

The e-signature facility offers:

- Assured security

- Ability to track who did what and when

- Easy & faster management of document signing process

- Simplified compliance validation

- Accurate audit trails with history of all changes and updates

- Simplified and accelerated workflows

E-Way bill

Businesses need to comply with GST regulations and generate E-way bills for transporting goods, which has been mandatory in India since April 1, 2018.

The purpose of the E-way bill mechanism is to ensure that transported goods adhere to GST law and to track the movement of goods and check for tax evasion.

It is imperative for businesses to have reliable software to generate and manage E-way bills.

BatchMaster’s Finance Suite streamlines the E-way bill generation process for businesses, replacing manual methods. With a click, businesses can upload the E-way bill on the portal. The suite ensures compliance with GST regulations by automatically updating the details of transported goods and generating necessary reports.

The software reduces the effort and time required to generate E-way bills and minimizes errors. It simplifies the process of generating E-way bills for invoices and challans.

The salient highlights of the E-way bill software in the Finance Suite are as follows:

- Saves time by instantly generating E-way bills

- Reduces errors through automatic processing

- Detect fraud by providing detailed information about the movement of financial data.

- Simple process to cancel, extend, and update E-way bills

- E-way bill dashboard to check the status of E-way bill transactions

- No worries about GST compliance

- Print E-way bill numbers on invoices and generate E-way bill documents.

- Facilitates faster movement of goods

GST Reconciliation

Reconciliation is the process of identifying discrepancies between the GST tax filed and the GST paid and collected during the purchase and sales process. The financial data in the ERP system is compared with the GST returns filed with the government to ensure that there is no discrepancy in the data.

This ensures GST compliance and helps organizations avoid penalty threats.

With BatchMaster's Finance Suite, GST reconciliation becomes easy. You don't have to collect financial data and verify it manually; the process is automatic, error-free, and fast.

The benefits of the GST reconciliation software in the Finance Suite include:

- Automates the data collection and comparison process, saving time and reducing errors.

- A Flags discrepancies that can be rectified later.

- Ensures compliance with GST norms.

- Improves the accuracy of financial data and brings transparency to financial reporting.

- Generates a detailed report highlighting the causes of discrepancies and showing the final tax liability or refund amount for the period.

- Auto-tracks non-compliant vendors, allowing for better management of the supply chain.

- Holds payment against non-compliant invoices.

- Automates follow-up with ITC credit recovery, streamlining the credit recovery process.

Highlighting Features of BatchMaster Finance Suite

- Tracks financial movements

- Checks audit trails

- Generates supporting documents instantly

- Offers a paperless process

- Provides more accurate financial reporting

- Enables top-to-bottom financial trail

- Ensures GST compliance

- Streamline Cash Flow system

- Provides timestamping for electronic transactions

- Offers strong login security measures

- Complies with various legal and governmental requirements related to document authentication

- Multi-user authentication

- Maintains complete trail of signatures

- Authenticates the identity of the signer of a document

- Generates various financial reports

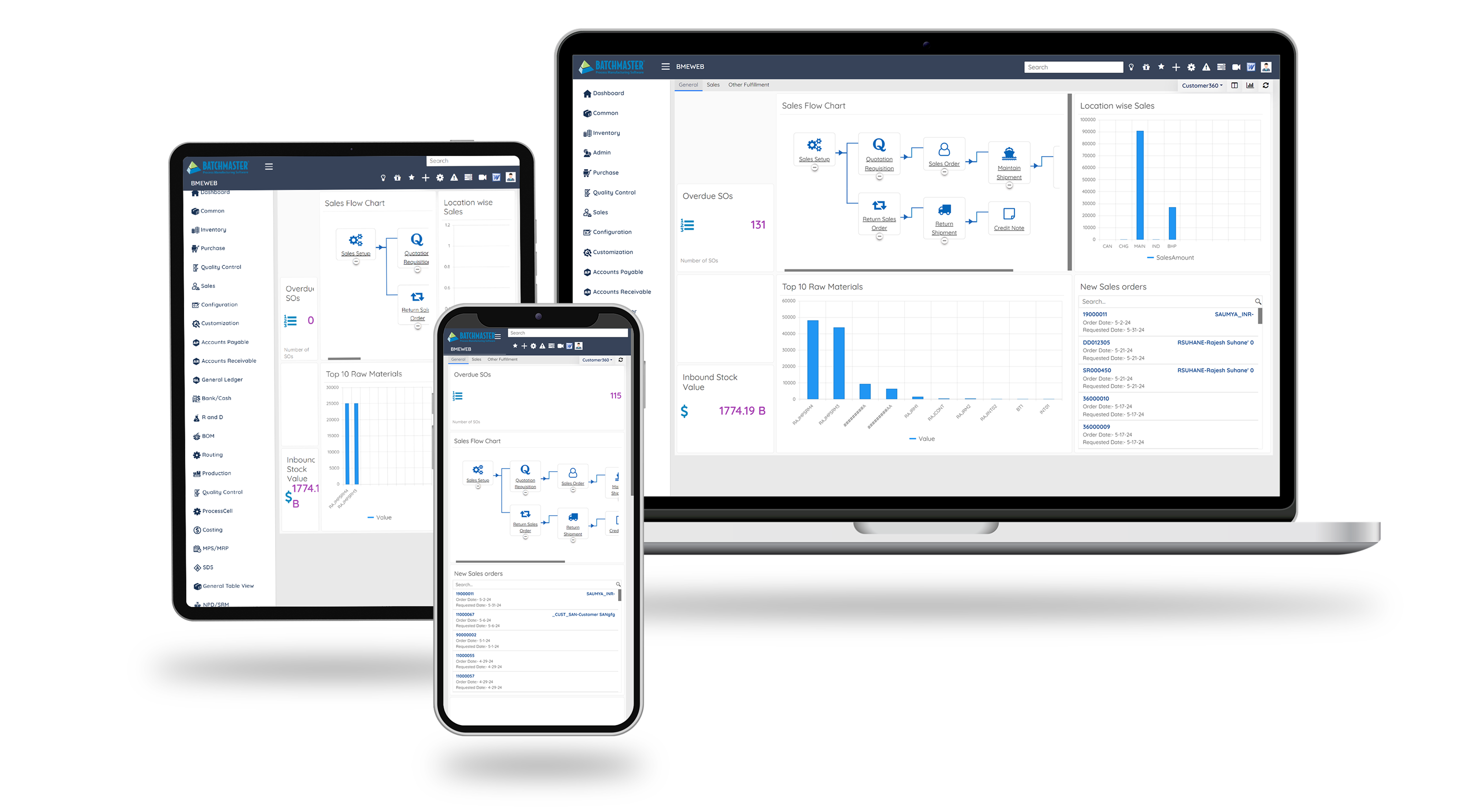

Run Our Manufacturing ERP With Your Existing Financials

Upgrade to our ERP without missing a beat in your financial and accounting routines. BatchMaster ERP offers seamless integration with Tally, QuickBooks, Sage 50/100/200/300, SAP Business One and other popular systems, ensuring a smooth transition.

Web/Cloud Deployment Available

Give your small, mid-size, or large-scale businesses the power of our ‘Cloud ERP’ solutions, and enjoy the benefits of leveraging the cloud.

Looking To Find Best Solution for Your Business?

Allow our expert team of solution consultants to review your business operations so that they can offer you the best-possible solution, either on premise or in the cloud, to meet all your industry-specific needs