Overview-

Finance is the backbone of every business. Every business runs with an aim of becoming successful and sustainable. However, most of the businesses fail due to bad financial planning and strategies.

“According to a report of Zippia.com, 22% of business startups fail in the first year, and 50% of businesses fail within the first five years. And poor cash flow management turns out to be the prominent reason in most of these cases.”

So, can’t anyone help businesses to become financially strong and stable?

Definitely, a CFO (Chief Financial Officer) can!

“Behind every proliferating business stands a robust financial management system, created by a competent CFO (Chief Financial Officer) of that company.”

But today, a CFO’s responsibility is much more than just tracking cash flow and managing financial planning. Instead, a CFO is expected to analyse the company’s financial strengths and weaknesses and put forward corrective actions that would prove beneficial for company’s future.

In some organizations, the CFO is even considered as a strategic partner who forecasts, plans, and oversees organizational progress. We can also entitle a CFO as a “calculated risk taker, who mitigates all the potential risks and capitalize on the upcoming opportunities”.

But do you really think all this can be done single-handedly by a CFO?

Can he manually handle these tedious tasks, perform heavy calculations, take thoughtful decisions depending on spreadsheet-based reports, et al? Realistically, CFOs need to empower themselves with a technological tool that gives the power of data at right time and at the right place.

Why Implementing a Finance & Accounting Software is Ineffective?

At this point, the first thought might come of implementing a software with basic accounting functionalities. This decision may prove right to some extent but not completely. As, the basic accounting software would not go beyond tracking sales, collecting payments, paying suppliers, and calculating profitability.

What about other crucial tasks like collecting financial data from all the departments, compiling it, generating insightful reports, providing a bird’s eye view of the entire manufacturing unit, creating future strategies based on that data, etc. These tasks hold equal importance to ensure precise financial management.

However, handling these tasks manually may be manageable while the organization is in its early stages, but as the company begins to grow and expand its operations, traditional practices will quickly become ineffective, inefficient, and prone to errors.

So, what do CEOs believe will improve their company’s financial situation?

What they want their CFOs to be good at? Let’s have a look.

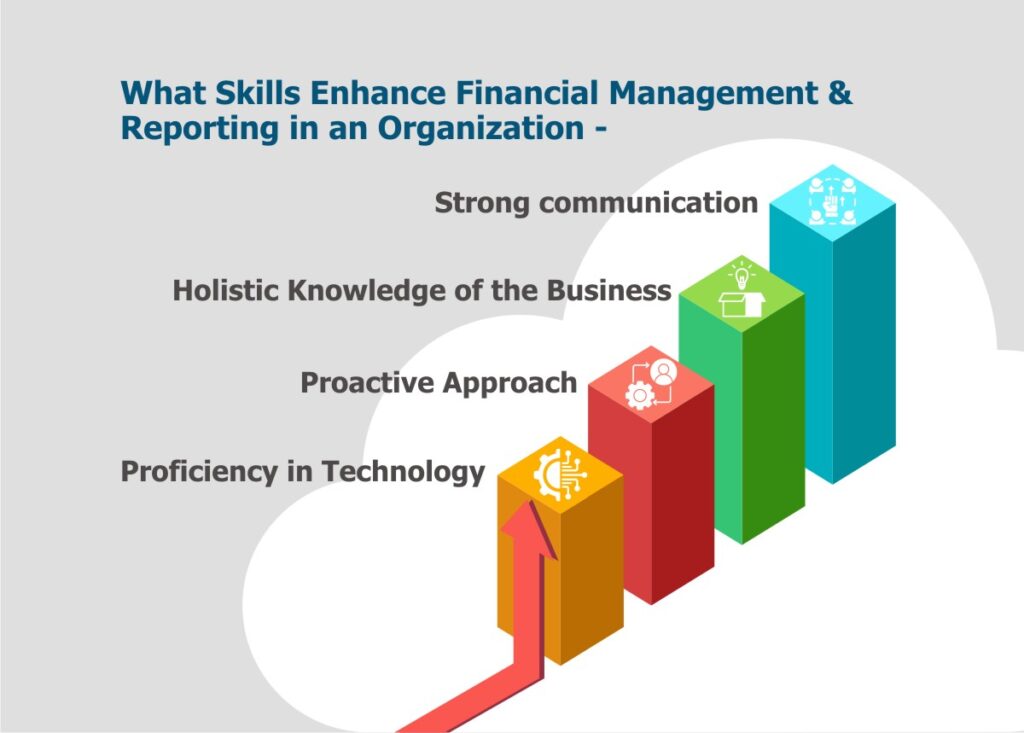

Skills That Enhance Financial Management & Reporting in an Organization-

- Strong Communication- CFOs are expected to build a strong communication, clearly articulating financial information and future-growth strategies to non-financial employees and stakeholders.

Know the Fact- Just 35% enjoy telling the company’s story through financial data, despite the criticality of that skill to get needed capital.

- Holistic Knowledge of the Business- CEOs expect their CFOs to have a comprehensive knowledge of the business including customers, competitors, and the company’s position in the marketplace.

- Proactive Approach- Considering the volatility of the past several years, CFOs need to have proactiveness and flexibility in their skillset to enhance their decision-making power.

- Proficiency in Technology – Today, the finance sector is highly modified by the digital revolution. Investing and focusing on the right technology will surely benefit organizations level up their profit game. But for that, CFOs need to have a working knowledge of possibilities and trends.

Long gone are the days when CFOs used to be just back-office bean counters. The message from the above discussion was resonantly clear that CFOs need to go well beyond tallying the balance sheet and contribute to the organization’s growth.

However, to accomplish this goal they need a strong and competitive supporting hand that could handle and manage all the routine financial operations seamlessly yet quickly, facilitating the CFOs to brainstorm on the other strategic aspects of the business.

In today’s fast-paced business environment, where CFOs are expected to plan their strategies extremely fast, then how not adopting an agile, flexible, and mobile technological tool would prove beneficial to the organizations?

This is the reason; companies are increasingly turning to Cloud-based Enterprise Resource Planning (ERP) Solutions.

Cloud ERP solutions not only streamline and automate the financial operations of a business but, it even empowers the CFOs by offering them a deeper view into all operations of the organization that impact the finance. Let’s understand this from the following points how does a cloud ERP benefits organization’s financial structure and CFOs at the same time.

How ERP Software Streamlines Financial Management for Businesses?

The ERP software through its excellent features, helps CFOs hone the above-mentioned skills and become the Active Drivers of Growth.

ERP facilitates them by providing detailed and insightful reports that simplify tasks and enable clear understanding of the complex concepts. Let’s see how.

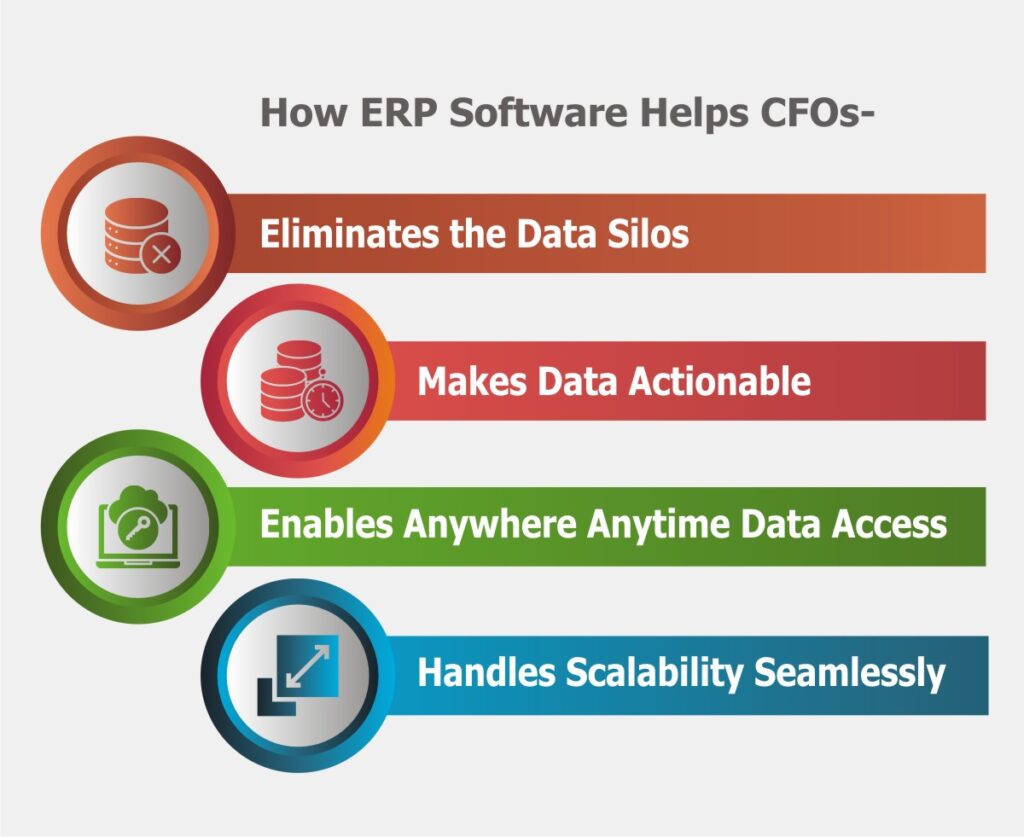

1. Eliminates the Data Silos- A digital transformation is considered successful only when the complete system runs on a single source of information, providing a holistic view of the complete business the way CEOs expect. (as discussed earlier)

If a CFO has its own set of information related to finance, the production manager has its own database of production, and the HR has its ow. Hope you can imagine what would happen? Massive confusion & miscommunication. Without strong integration, how could a CFO present the information to the stakeholders?

This is where human efforts fail, an ERP for finance & accounting system simply excels. It collects, complies, and reports all the information from all the siloed departments, avoiding these hassles and making available the data needed.

2. Makes Data Actionable- It’s the intelligence that makes the data actionable. It’s not just that an ERP will only increase visibility by providing you real-time data in the form of interactive, and insightful dashboards. But it will even enhance CFOs’ transparency into the operational KPIs.

So that, when issues arise, an ERP system allows CFOs to act proactively by diving deep into the relevant data, enabling quick identification of the root cause. Moreover, such interactive dashboards revealing detailed analysis, facilitates CFOs to communicate properly with the stakeholders regarding the company’s financial position and helps in developing effective strategies for a promising future as well.

3. Enables Anywhere Anytime Data Access- Unlike traditional practices where data is often limited to on-premises access, a Cloud ERP solution allows CFOs to access up-to-date financial information from any device with internet connectivity.

Information related to cash flow, profit margins, or budget variances that demand quick response and action are available on a click. The Finance ERP on Cloud allows CFOs to monitor the performance all time, enabling informed and quick decisions—regardless of their physical location.

4. Handles Scalability Seamlessly- Expanding a business nationwide or globally with new branches, involve loads of calculations such as conversion of currency, sorting out differences in depreciation, revenue recognition, etc.

Moreover, along with the business growth, grows the number of assets and liabilities of the organization. Managing everything together during this growth requires not only CFOs’ strategic oversight but also their competence to manage the growing demand.

With a competent Cloud ERP for Finance & Accounting, that operates on subscription basis, CFOs can easily scale the ERP system to accommodate new business units, locations, or markets, without the need for upgrading costly infrastructure. Moreover, its multicurrency, multi-language, multi-location support eases out the reporting and decision-making.

Final Thoughts-

As the role of the CFOs is evolving with time, they need to focus on guiding the organization towards growth by identifying opportunities and setting strategic direction.

With the help of proper insights, the CFOs can develop strategies and confidently present them to their CEOs and board members for approval.

And this is possible only when they adopt an efficient ERP module for financial management like BatchMaster ERP on Cloud that not only impacts financial management but helps managing the company as a whole.

If you are a CFO and encountering the same set of challenges then, we assure you, choosing BatchMaster will help you achieve your goals soon. Contact our team of experts today to know more about it.